quickbooks credit card processing limit

As your business grows your credit line can too. By Green Dot Bank FDIC member.

Is There A Limit To How Much Can Be Processed When A Customer Pays For An Invoice Through Quickbooks Online

Deposit times may vary.

. Square Payments is a secure and reliable credit card processing platform. Track payment in real time and automate your accounting. Instantly provision cards manage company expenses in real-time and earn extra cash back.

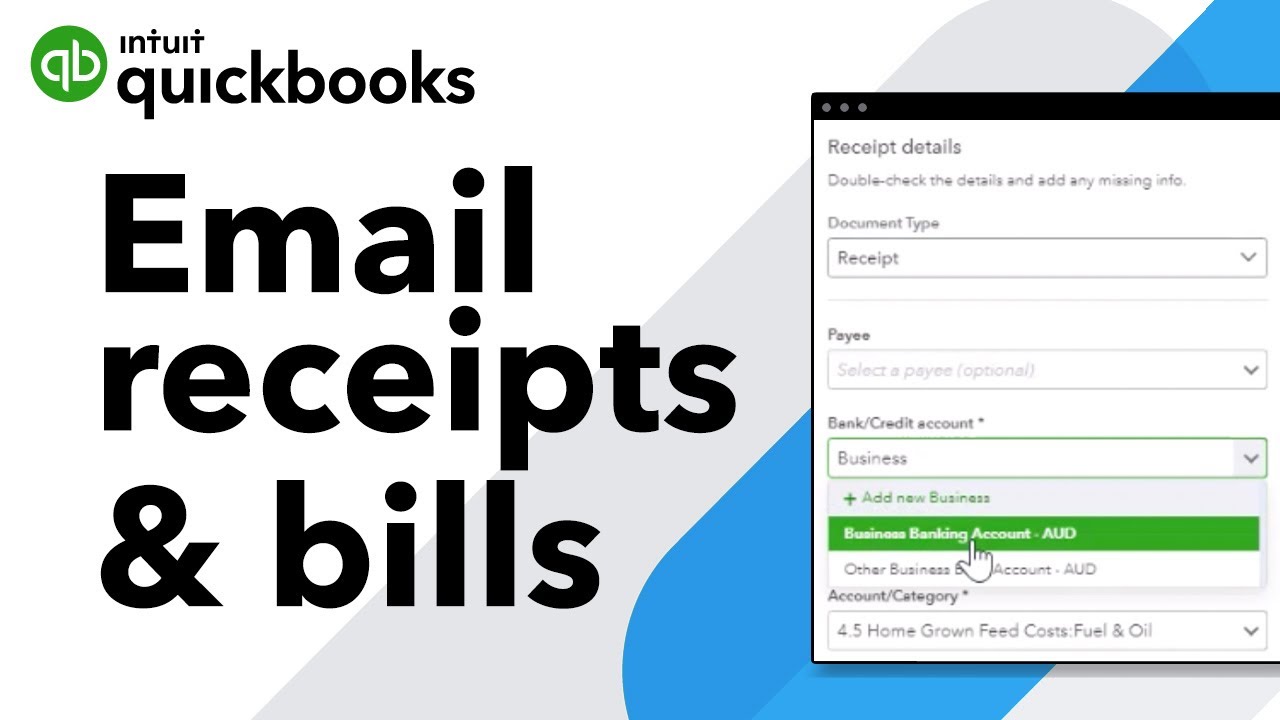

Get paid in QuickBooks. Most card issuers list the credit amount as a negative balance on the card. Credit card processing is fast and easy with QuickBooks Payments.

The account and any money in Envelopes are FDIC insured to the standard 250000 limit Tips to raise your payments game. Perhaps more than anything else credit card processing apps offer the ability to make POS transactions far away from dedicated infrastructure and without the use of carbon paper. The company offers a free mobile credit card reader that plugs into any.

Get started with low credit card processing fees for your product or service today. Its advanced solutions and broad feature-set makes it a great fit for most businesses. For new QuickBooks Payments users credit card payments deposit on the next business day.

If you want to limit the number of dedicated hardware devices in your life a credit card processing app can turn phones and tablets into serviceable. Your first year of M1 Plus is free - a 125 value. Deposits are sent to the bank account linked to your QuickBooks Debit Card in up to 30 minutes.

Your credit limit is determined by your payment processing and bank history. Faster deposits Credit card processing ACH and eChecks ECommerce. We recommend Square Credit Card Processing Get a free credit card reader when you sign up.

No credit card required. QuickBooks Online subscribers can use the GoPayment app on a pay-as-you-go basis in which case card reader payments cost 24 25 and keyed transactions cost 34 25. You accidentally make two 500 payments.

Square made a name for itself in 2009 by offering small businesses an easy-to-use all-in-one credit card processing system. Coverage limit is. Lets say you have a 500 balance on your credit card.

Automated expense accounting is directly compatible with QuickBooks Xero Sage. The credit card payment app can be used without a monthly subscription as long as youre subscribed to a QuickBooks Online or Desktop accounting package. The company credit card for fast-growing businesses.

Manage your accounting get invoices paid accept. Earn a credit limit increase after making 5 monthly payments on time within 10 months from account opening when meeting credit criteria. 95 credit card annual fee waived for active M1 plus members.

Center Introduces Credit Quickbooks Integration Center

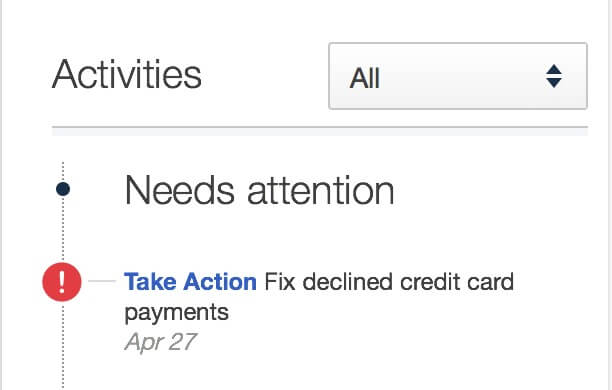

Managing Declined Credit Cards In Quickbooks Online Royalwise

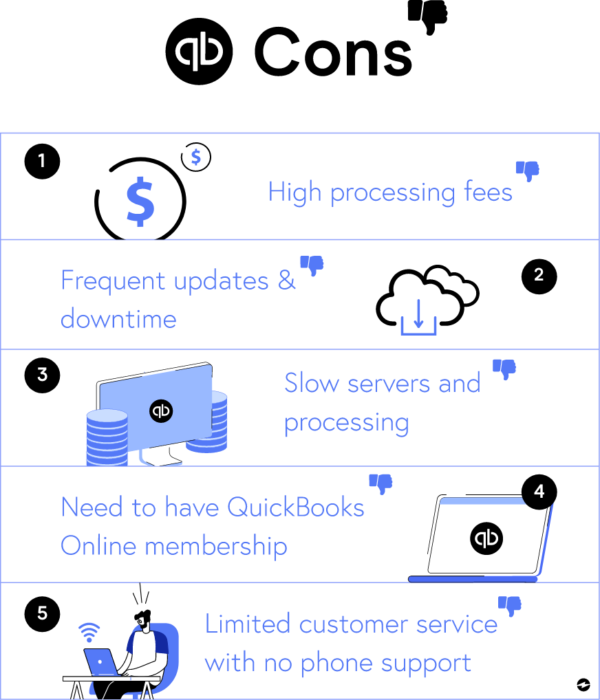

9 Pros And Cons Of Using Quickbooks Payments In 2022

Advantages And Disadvantages Of Credit Cards Credit Card Paying Off Credit Cards Compare Credit Cards

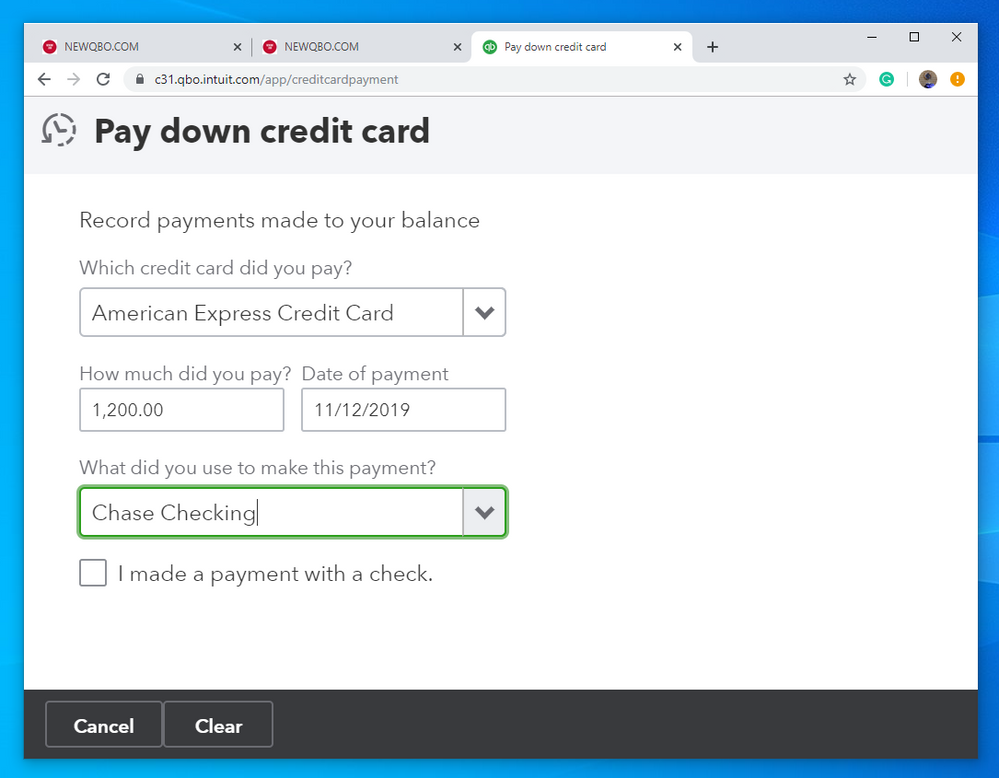

Solved How Does The New Feature Pay Down A Credit Card Work Does It Replace The Bill Entry Or Expense Screen When Paying A Credit Card Payment

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

How To Properly Enter Credit Cards In Quickbooks Workshop Live Q A Youtube

Take And Process Payments With Quickbooks Payments

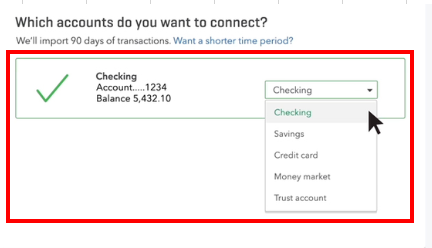

How To Set Up A Credit Line In Quickbooks Online And Have It Import Transactions

Connect And Review Your Banking In Quickbooks Online

What Are The Limitations Of Quickbooks Online Consero Global

10 Step Guide How To Use Quickbooks Online Float

How To Get A Credit Limit Increase On A Credit Card Credit Card Payoff Plan Credit Card Deals Paying Off Credit Cards

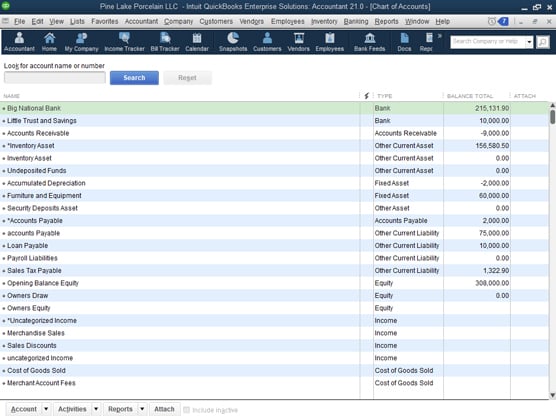

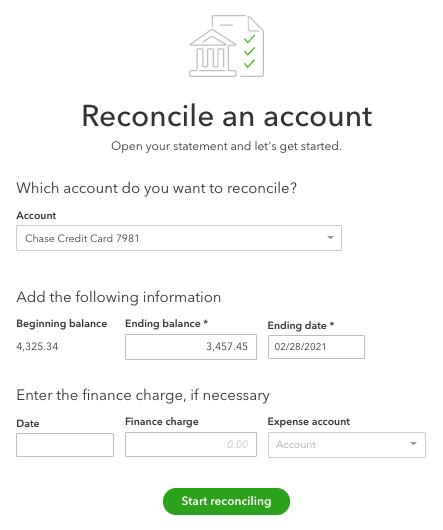

Credit Card Transactions In Quickbooks 2021 Dummies

Quickbooks Payments Review 2022 Intuit Merchant Services

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

Recording Credit Card Transactions In Quickbooks Best Practices